When we think about leaving a legacy for our families, we usually think about the big things. We think about the life insurance payout that will cover the bond. We think about the jewellery passed down to a daughter, or the vintage watch left to a son. We think about the Last Will and Testament that ensures everyone is treated fairly.

We do these things because we love them. We want to protect them.

But there is a different kind of protection that very few of us think about, and it has nothing to do with money. It is the gift of clarity.

As I recently shared in my interview with Cape Talk, the most painful struggles families face after a loss often aren’t financial—they are logistical. Leaving your family to guess your passwords, hunt for policy documents, and navigate your digital life without a map adds anxiety to their grief.

That is why getting organised isn’t just “admin.” It is a profound act of love.

The Burden We Unintentionally Leave Behind

Imagine the scenario: You have passed away unexpectedly. Your spouse is heartbroken. They are trying to arrange a funeral, comfort the children, and deal with family flying in from overseas.

In the middle of this emotional storm, they realise they need to pay the electricity bill, but the banking app is on your phone, and they don’t know the passcode. They need to find the funeral policy, but it’s in a PDF in your email, and they can’t log in.

Instead of grieving, they are fighting with call centres. Instead of reminiscing, they are guessing passwords.

This chaos is preventable. Give them the gift of peace with the In Case of Death Planner.

The “Digital Lock-Out” is Real

In the Eyewitness News (EWN) article covering my recent tool, we highlighted a modern reality: Two-Factor Authentication (2FA).

“Most of us will have our will set out… but in the case of a death plan, it covers more logistical, practical things that we tend not to think of because it’s not spoken about very often.” — Karin Meyer, via EWN

In the old days, you could find a paper file in a cabinet. Today, our lives are locked behind screens. If you are the “Chief Admin Officer” of your household (and let’s be honest, in most homes, one person holds all the keys), your passing could freeze the entire household’s operations.

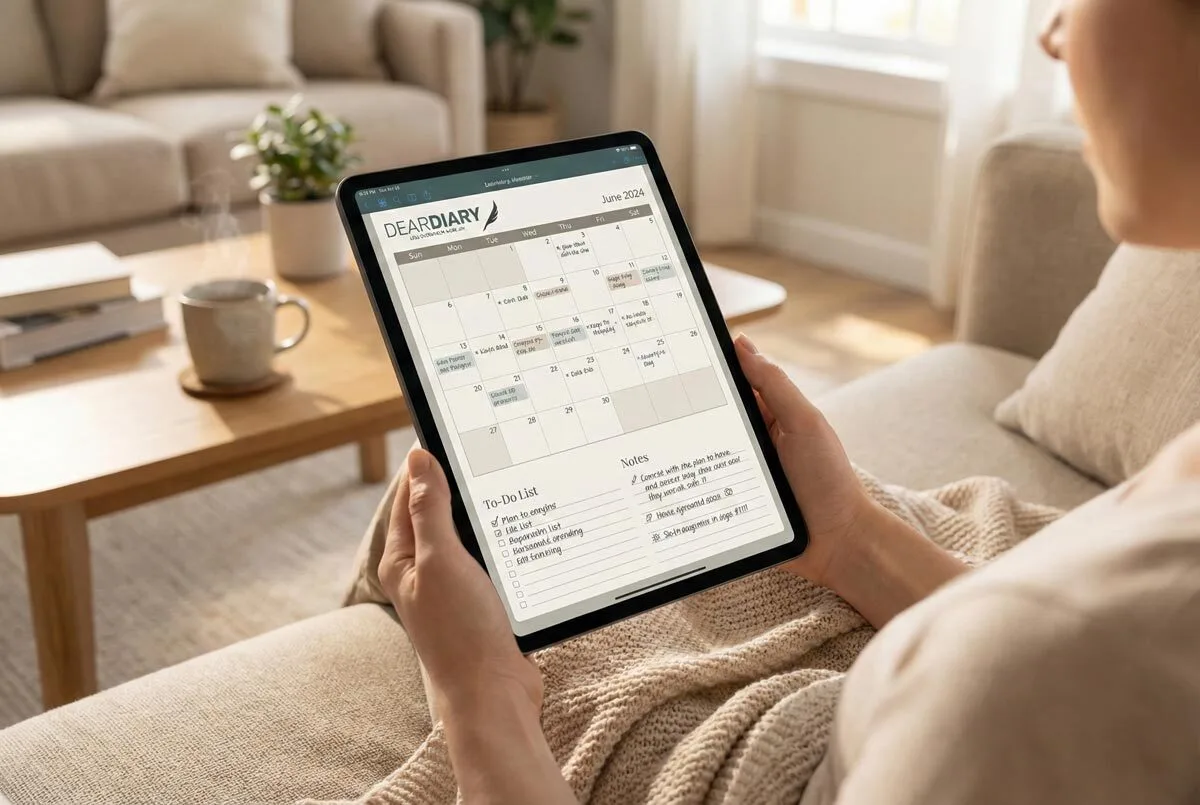

I specifically designed the In Case of Death Planner to solve this 21st-century problem. It includes dedicated sections for:

- Device PINs: For phones, tablets, and laptops.

- Email Access: The gateway to almost every other account you own.

- Social Media Wishes: Do you want your Facebook profile memorialised or deleted?

- Subscription Services: Preventing monthly fees from bouncing off a frozen bank account.

Read the full article on EWN about why this tool is helping South Africans cope.

It’s Not Morbid, It’s Merciful

I know it feels uncomfortable to sit down on a sunny Saturday morning and write down your funeral wishes or your bank details. It feels contrary to life.

But I want you to reframe that thought.

Don’t think of it as planning for death. Think of it as planning for their peace.

Every field you fill in on this planner is one less panic attack for your spouse. Every password you record is one less hour they have to spend on hold with a bank’s fraud department.

As I mentioned on air, you should entrust this document to someone capable of staying focused during bereavement—whether that is your partner, a parent, or your best friend.

You have got the Will. You have got the Policy. But do you have the other 5 critical documents that South African banks demand before unfreezing an account? Most people miss #3.” 👉 See the full checklist in our Ultimate Death Admin Guide.

Give The Gift of “I Sorted It For You”

We can’t protect our loved ones from the sadness of losing us. That is the price of deep love. But we can protect them from the chaos of it.

When they open your “Just In Case” folder and see that you have listed the florist you like, the code for the gate, and the number for the insurance broker, they won’t just see a list. They will see a love letter. They will see that you cared enough to make the hardest days of their life just a little bit softer.

Spare Your Family the Chaos

Join the thousands of South Africans who are taking control of their life admin after hearing us on Cape Talk.

Download the ‘In Case of Death’ Planner Here 30 Pages. Instant Digital Access. The most thoughtful gift you’ll ever buy.